Father-Son Duo Launch Online Financial Literacy Summer Camp

They’re on a mission to inspire the next generation of wealth-builders — and they’re doing it together as a family.

Kevon Chisolm and his 16-year-old son Kamari are the founders behind Junior Wallstreeters, Inc., a nonprofit dedicated to improving financial literacy among young people, particularly in underserved communities. As reported by Black Enterprise, the organization is now entering its fourth year of operation, and its summer camps have quickly earned national attention for offering a dynamic, culturally grounded approach to teaching money management and long-term wealth creation. (Black Enterprise)

Building Wealth, Building Community

Chisolm explains that what makes Junior Wallstreeters different is its commitment not only to personal finance but also to collective wealth strategies:

“In addition to topics like budgeting, banking, and investing in the stock market, our camp goes beyond others by exploring community wealth building through investment clubs.”

This emphasis on community-based economics aligns with broader conversations happening across the country. Financial experts have noted the importance of early financial education in narrowing the racial wealth gap, especially for Black and brown families who historically faced systemic barriers to wealth-building. (Forbes, NPR)

A Curriculum Rooted in Culture and Real Skills

The Junior WallStreeters: Empowering Youth with Financial Wellness Camp offers a unique 10-lesson curriculum that blends foundational financial skills with African American history and cultural learning. According to Chisolm, this connection helps students better understand the historical context of economic inequality while empowering them with the tools to change their futures. (Black Enterprise)

The father-son team strongly believes that financial literacy is one of the most effective ways to close the long-standing wealth gap:

“Our goal is to teach financial education to address the wealth gap by showing young people how to properly use money as a tool,” Chisolm said.

A Digital Camp for the Modern Era

The program is open to students ages 12 to 21, requiring only a computer and Internet access. The camp’s sessions have expanded over the years to meet the rising interests of young investors. In addition to core classes on budgeting, saving, and traditional investing, students can also take:

-

Introduction to Cryptocurrency and NFTs

-

Stock Analysis for Beginners

-

Investment Club Fundamentals

These courses reflect the rapidly changing financial landscape, giving young people insights into emerging markets that many adults are only beginning to learn about. (Forbes)

Camps run virtually every two weeks over a six-week period from June 26th – August 4th, operating from 10:30 a.m. to 3:30 p.m. EST. Registration ranges from $300 to $325, which includes daily class access and an electronic student handbook.

Importantly, Junior Wallstreeters also offers multiple scholarships designed to assist families who may not have the financial means to participate. Chisolm emphasizes that accessibility is central to their mission:

“We want to give as many students the opportunity to obtain a financial education regardless of their parent’s financial situation.”

A Vision for the Future

Junior Wallstreeters’ impact continues to grow, with parents, educators, and community leaders praising the program for giving young people the knowledge they need to navigate the economy of the future. As financial literacy becomes an increasingly essential skill, programs like Chisolm’s are helping ensure that underserved youth don’t get left behind. (NPR, Black Enterprise)

The father-son duo hopes their work will spark a long-term movement — one where financial empowerment becomes the norm for young people of color, not the exception.

News in the same category

Strictly Come Dancing star eliminated from competition on their birthday

Coronation Street's Lucy Fallon shows off huge ring as she announces engagement

MAFS UK’s ‘strongest’ couple split after romantic display at reunion

Princess Beatrice says ‘it can be incredibly lonely’ in new podcast interview

I'm A Celeb's Kelly Brook's brutal response about her weight to online trolls

Kerry Katona says birthday ‘triggers’ depression over foster care memories

MAFS UK’s Davide breaks silence over ‘painful’ split from Keye

If You See A Purple Butterfly Sticker Near A Newborn, Here’s What It Means

16-Pound Giant Baby Made Headlines In 1983, But Wait Till You See Him Today

World’s Most Secret Underground Villa Built By A Woman Living Off The Grid

My nana taught me this hack to deodorize trash cans in 2 mins with 0 work. Here’s how it works

Neat Hack

I Had No Idea What That Little Fabric Square Was For — Until Now

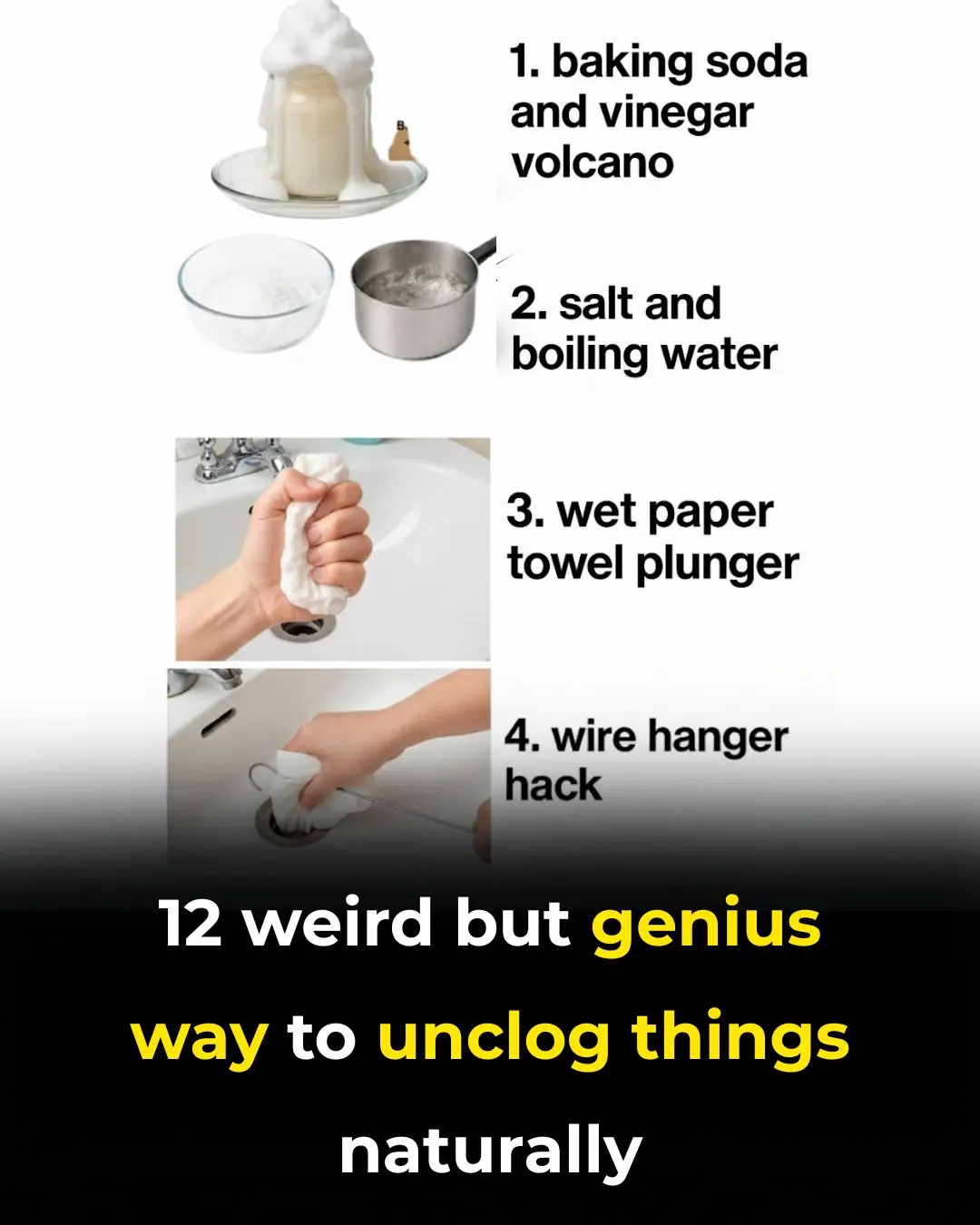

12 Weird but Genius Ways to Unclog Things Naturally

Put Borax on Wax Paper and Slide It Under Your Fridge — Here’s Why

10 Surprising Ways to Use Vinegar Around the House

Works Like a Charm

My nana taught me a brilliant 2-minute hack that makes dusty blinds sparkle with zero effort — here’s how it works

Woman Turns Boeing Plane Into Fully Functional Home

News Post

7 Ways To Use Vaseline For Wrinkle Free, Flawless Skin

EVERYTHING JAMES FRANCO SAID ABOUT BEING ‘CAST OUT’ FROM HOLLYWOOD DURING HIATUS

The #1 seed that makes bones & muscles strong—how to use it!

14 Warning Signs of Low Magnesium Levels and What to Do About It (Science Based)

Strictly Come Dancing star eliminated from competition on their birthday

Top 10 Foods to Heal Knee Pain and Boost Cartilage Naturally

Blood Type O Diet: What to Eat and What to Avoid

7 nutrients that actually repair nerves

Coronation Street's Lucy Fallon shows off huge ring as she announces engagement

MAFS UK’s ‘strongest’ couple split after romantic display at reunion

The Versatility and Benefits of Orange Peel Powder

The Hidden Power of the Honey Locust Tree (Gleditsia triacanthos): Health, Healing, and Everyday Uses

This one vitamin could help stop you from waking up to pee every night

The Cold Room Sleep Trick That Can Transform Your Health

Princess Beatrice says ‘it can be incredibly lonely’ in new podcast interview

Leaf of Life – The Healing Plant Growing in Your Backyard (And You Had No Idea!)

I'm A Celeb's Kelly Brook's brutal response about her weight to online trolls

Kerry Katona says birthday ‘triggers’ depression over foster care memories

Why You Should Be Putting Salt in Your Toilet