Why Is Sebastian Telfair Back Living in the Projects After Nearly $19M in NBA Money?

Sebastian Telfair has learned the hard way that earning money and keeping money are two entirely different skill sets — a lesson that has defined both his career and life after basketball.

NEW YORK, NY — Once hailed as a Brooklyn phenom, Telfair earned nearly $19 million over his NBA career, but life has shown that even substantial earnings do not guarantee financial stability (Complex, ESPN). His new documentary, “Sebastian Telfair: Final Days of Freedom,” captures the rapid unraveling of wealth when legal troubles, personal challenges, and a lack of long-term planning intersect.

A native of Coney Island, Telfair grew up in the Mermaid Houses, the same housing development that produced other basketball talents like Chris Taft, and is cousin to former NBA star Stephon Marbury and brother of Jamel Thomas. Entering the NBA, Telfair was convinced that basketball would be his ticket out of the projects — and for a time, it was. He became a local legend in New York City before being drafted, his future appearing secure as the dream of professional success seemed fully realized (The New York Times).

“The day I picked up a basketball was the day I knew I was going to make it out,” Telfair reflects in the documentary. “I played over 10 years in the NBA and made tens of millions of dollars. I had everything I ever dreamed of.”

Yet even the brightest careers can face sudden downturns. Following a series of legal issues and personal challenges, Telfair found himself back in the environment he had worked so hard to escape. “I’m right back to where it all began. Back in Coney Island, back in the projects, back in the fire,” he continues. His legal struggles intensified in 2017 after an arrest involving unlicensed firearms (Complex), and later, a guilty plea in a $358,000 healthcare fraud investigation compounded his financial difficulties.

“Fighting the feds and my divorce affected my finances. Now I got to run around broke,” Telfair admits. Although one conviction was overturned, a subsequent violation of release terms led to a six-month sentence at FCI Fort Dix, where he was photographed alongside Sean “Diddy” Combs (TMZ).

Telfair’s situation, while dramatic, is far from unique in professional sports. Many athletes struggle with wealth management, often facing steep declines once their careers end. NBA star Antoine Walker, for instance, earned $108 million during his career but declared bankruptcy within two years of retirement. Walker later acknowledged that attempts to emulate the extravagant lifestyles he saw in entertainment — from luxury cars to high-end real estate and gambling — without financial planning eroded his fortune. He has since become an advocate for financial literacy among athletes (ESPN).

Basketball Hall of Famer Charles Barkley has long emphasized that overspending, poor planning, and trying to impress others are among the main reasons athletes lose their wealth. He often stresses that athletes underestimate how short their professional windows can be, making disciplined money management crucial (The New York Times).

Not every athlete falls into this trap. Serena Williams exemplifies strategic financial thinking; her father made her manage her own endorsement deals as a teenager, including a multimillion-dollar Puma contract. Early exposure to financial responsibility allowed her to build discipline and turn earnings into long-term value (ESPN). Similarly, Philadelphia Eagles quarterback Jalen Hurts has maintained a modest lifestyle while strategically investing in real estate. Even after signing a record-breaking contract, Hurts purchased a $215,000 home for his parents, a $6 million estate, and adjacent property, structuring his wealth to ensure family support and sustainable income streams. His approach contrasts sharply with the spending patterns that have derailed many athletes.

Telfair’s return to the projects is a stark reminder that high income alone does not equal stability. His story underscores a lesson often repeated across professional sports: without financial education, long-term planning, and disciplined money management, even the wealthiest athletes can face serious setbacks. It is a cautionary tale, but also one that highlights the importance of learning from mistakes and preparing the next generation to navigate both fame and fortune responsibly (Complex, TMZ, ESPN).

News in the same category

France Reimagines Shelter Boundaries With Community Corn Walls

“New Research Reveals How Aging Impacts Male Fertility and Sperm Health”

Discover how eggs support your baby’s brain development — full details in the comments!”

Blueberries: A Powerful Daily Boost for Heart Health

😭 Backlash Follows Carlos Gu's Emotional Breakdown on Strictly Come Dancing

👑 Former Campmate James Haskell Backs Martin Kemp for King of the Jungle

📉 The Upside Down of Broadway: Stranger Things Play Faces Financial Turmoil Amid Soft Ticket Sales

🪂🐍 I’m A Celebrity… 2025 Launch: Winners Secure Steak Dinner as Kelly Brook & Campmates Face the ‘Cockie Van’

🎶 Shona McGarty: From Walford to the Wild and Her New Chapter in Music

👨👩👧👦 Peter and Emily Andre’s Son Theo Makes Rare Appearance in Family Home Video

🌴 Kelly Brook’s Jungle Challenge: Body Positivity, Feuds, and a U-Turn

👨👧👦 Sam Thompson Shares "Freaking Out" Fears Over Baby Plans with New Girlfriend

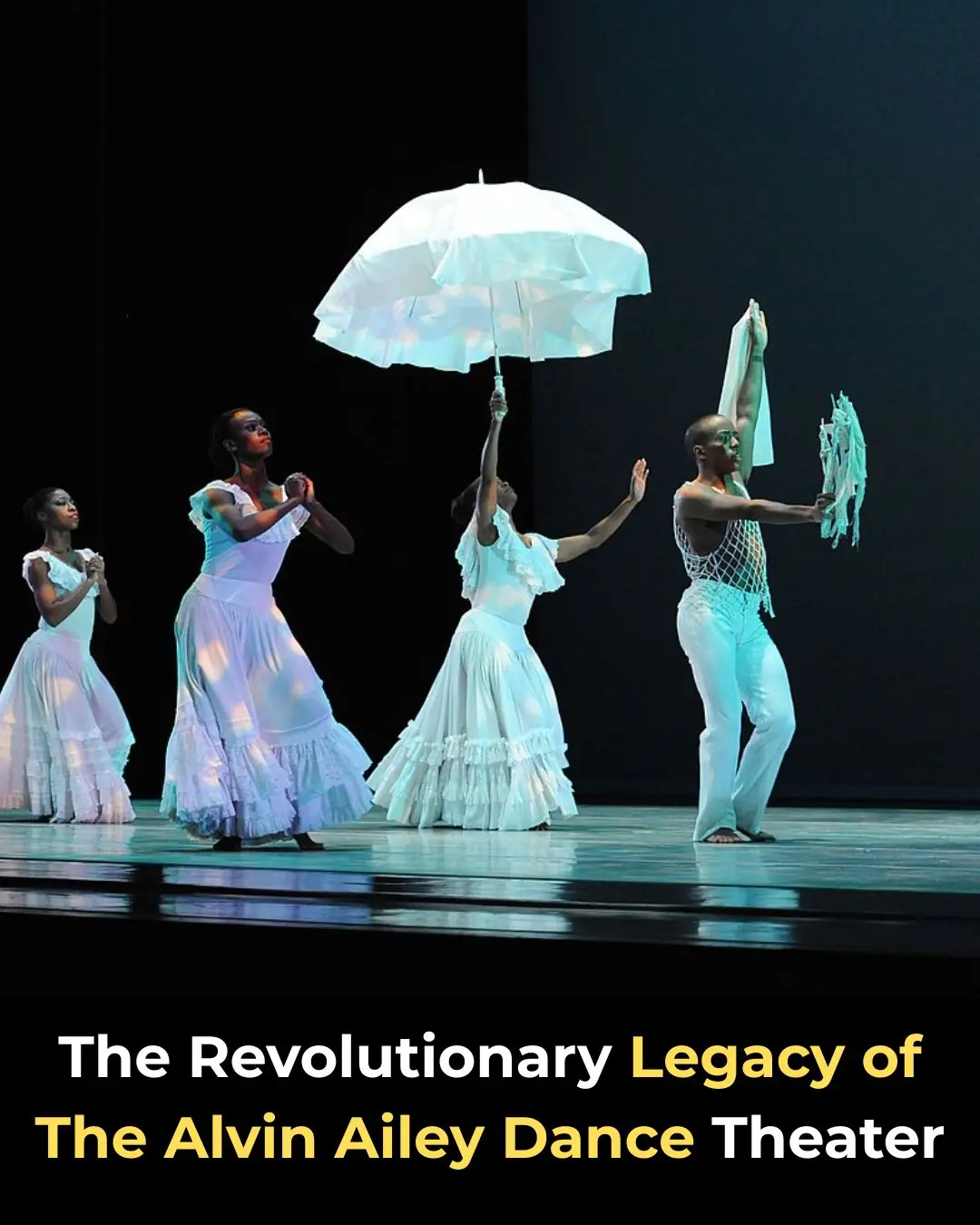

The Revolutionary Legacy of The Alvin Ailey Dance Theater

Memphis Teen Gives Back To Community By Giving Free Haircuts To The Homeless

Meet the Couple Making History as First Duo to Serve as HBCU Rectors Simultaneously

Rapper Lupe Fiasco Named Visiting Professor at Johns Hopkins’ Peabody Institute

NBA Star Anthony Edwards Gets Surprise Game Visit From His 82-Year-Old Grandfather

Vicky Pattison shares statement after sparking concerns with It Takes Two absence: ’So sorry’

News Post

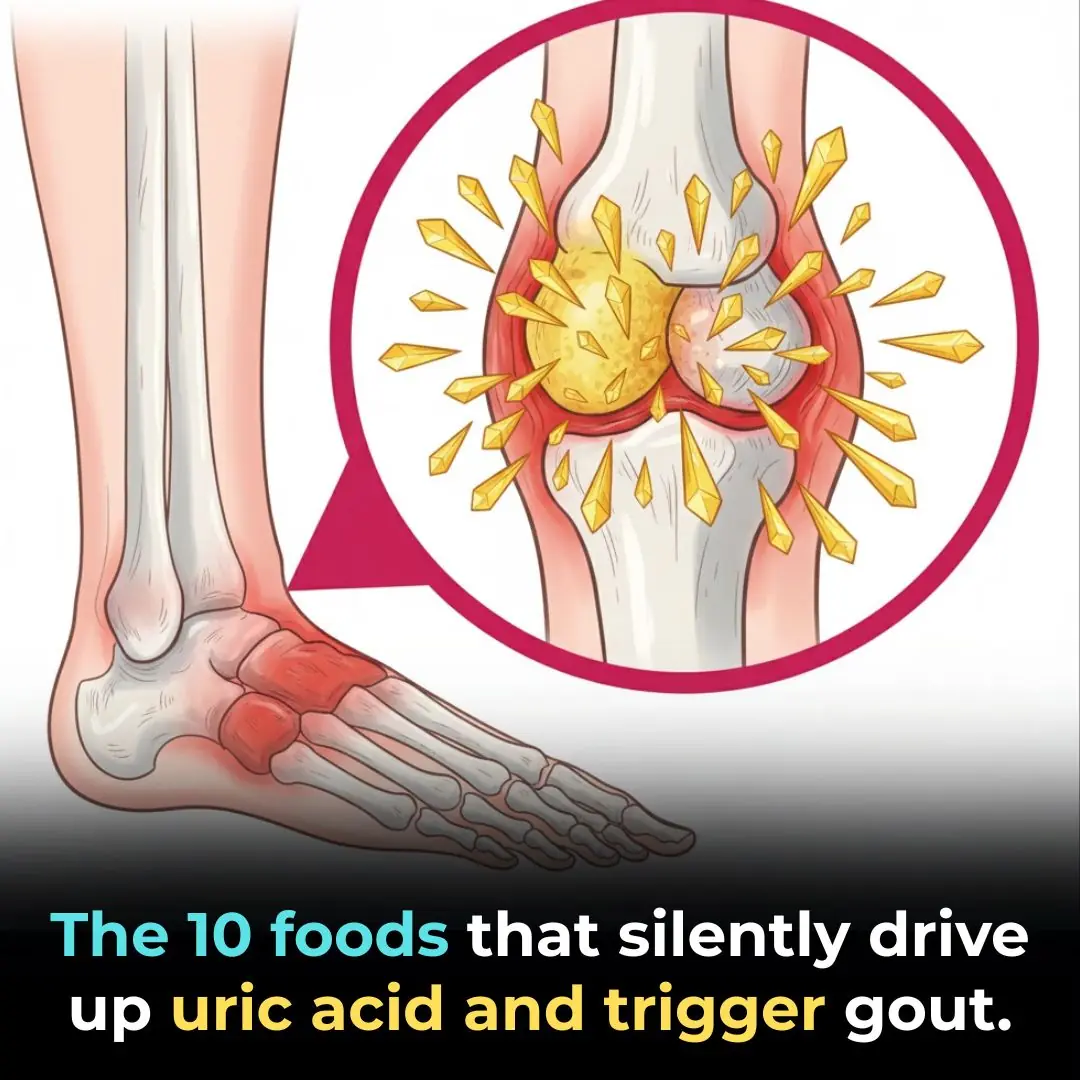

Top 10 Uric Acid Foods To Avoid If You Have Gout

Belgium’s Floating Algae Mats: A Green Breakthrough in Urban Water Purification

France Reimagines Shelter Boundaries With Community Corn Walls

5 Simple Ways to Remove Rust from Knives – Make Your Dull, Rusty Knife Shiny and Sharp Again

5 Fruits on the ‘Blacklist’ That Can Cause Cancer – Avoid Buying Even If Cheap

“New Research Reveals How Aging Impacts Male Fertility and Sperm Health”

Pork Skin – The Often Overlooked Superfood

Don’t Throw Away Lemon Peels! Use Them for These 8 Household Tasks and Save a Ton of Money

10 surprising ways to use vinegar around the house

Stop eating these 10 things of CRAP

Mix Banana Peels With This and Leave It in a Corner — Roaches Will Disappear Overnight

Discover how eggs support your baby’s brain development — full details in the comments!”

Weak Toilet Flush and No Suction? A Simple Trick From a Professional That Fixes It Instantly

Five “Dirtiest” Parts of the Pig That Butchers Never Take Home for Their Own Families

Blueberries: A Powerful Daily Boost for Heart Health

The Whole Family of Three Was Diagnosed With Thyroid Nodules; the Mother Collapsed: “I Thought Those Two Things Were Always Good to Eat and Could Prevent Cancer”

Motherhood Rewires the Brain: Why Postpartum Recovery Takes Years, Not Weeks

Eating More Than One Egg a Week May Slash Alzheimer’s Risk by 47%

CRISPR Breakthrough Offers Hope for a Potential HIV Cure