Former Fibrebond CEO Shares $240 Million in Bonuses After $1.7 Billion Sale

Graham Walker’s Extraordinary Act: $240 Million in Bonuses for Fibrebond Employees After $1.7 Billion Sale

Graham Walker, the former president and chief executive officer of Fibrebond Corporation, captured global attention with an extraordinary gesture of generosity after selling his family-run business for $1.7 billion. Walker ensured that **15 percent of the sale’s proceeds — approximately $240 million — were distributed as bonuses to the company’s full-time workforce of 540 employees, even though none of them owned company stock. This rare decision made headlines worldwide, highlighting a fresh approach to sharing corporate success beyond traditional stock ownership or executive pay.

Fibrebond, based in Minden, Louisiana, is a manufacturer of electrical equipment enclosures and modular power solutions. The company was founded in 1982 by Walker’s father, Claud Walker, and over the decades it encountered several challenges — from a devastating factory fire in 1998 to the collapse of the dot-com economy in the early 2000s — before emerging as a significant player in the industry. Under Graham Walker’s leadership, the company reinvented itself and capitalized on the rising demand for data center infrastructure, leading to significant growth and ultimately attracting acquisition interest.

According to reports from The Wall Street Journal and other major outlets, Walker made the bonus plan a non-negotiable condition of the sale to Eaton, a global power management firm that completed the acquisition earlier in 2025. Walker told prospective buyers that unless employees were given a meaningful share of the proceeds, he would not agree to sell. Eaton agreed to the term, with company representatives later noting that the arrangement honored commitments to both employees and the local community.

The total bonus pool — $240 million — works out to an average of about $443,000 per employee, though individual amounts varied based on length of service and continued employment through a five-year vesting period. The payout plan was structured to retain staff during the transition and maintain operational continuity under new ownership, but also to reward long-tenured workers with higher bonuses.

Workers received sealed letters in mid-2025 notifying them of their awards, and many were initially stunned. Some thought the announcement was a joke or a prank, while others responded with overwhelming emotion upon realizing the life-changing nature of the bonuses. Employees described paying off mortgages, clearing credit card debt, funding college tuition, investing in retirement, and even launching small businesses with the money. One longtime employee, Lesia Key, who started at Fibrebond in 1995, used her bonus to pay off her home mortgage and open a boutique — a chance she described as transformative after years of living paycheck to paycheck.

The impact of Walker’s decision extended beyond individual employees to the local community. In a town of around 12,000 people, the sudden influx of cash bolstered local spending and stimulated economic activity, which local leaders said offered a rare positive boost to the region’s economy.

Corporate leaders and economists have pointed to this example as an unusual but powerful case of sharing financial success with employees, particularly in an era marked by widening income gaps and increasing scrutiny of executive compensation. Industry commentators have compared Walker’s move to other notable cases in business where founders have shared rewards with workers, though such gestures remain relatively uncommon in privately held manufacturing companies.

Walker, now stepping down from his role at the end of 2025, has expressed hope that the bonuses will forever change his employees’ lives for the better. In his own words, he wanted those who helped build the company through decades of hard work and loyalty to “experience the joy of shared success,” a phrase that encapsulates his approach to leadership and the sale itself.

News in the same category

David Spade says he spent 25 years trying to get Eddie Murphy to stop hating him: 'He was a hero'

Beyoncé Is Now A Billionaire

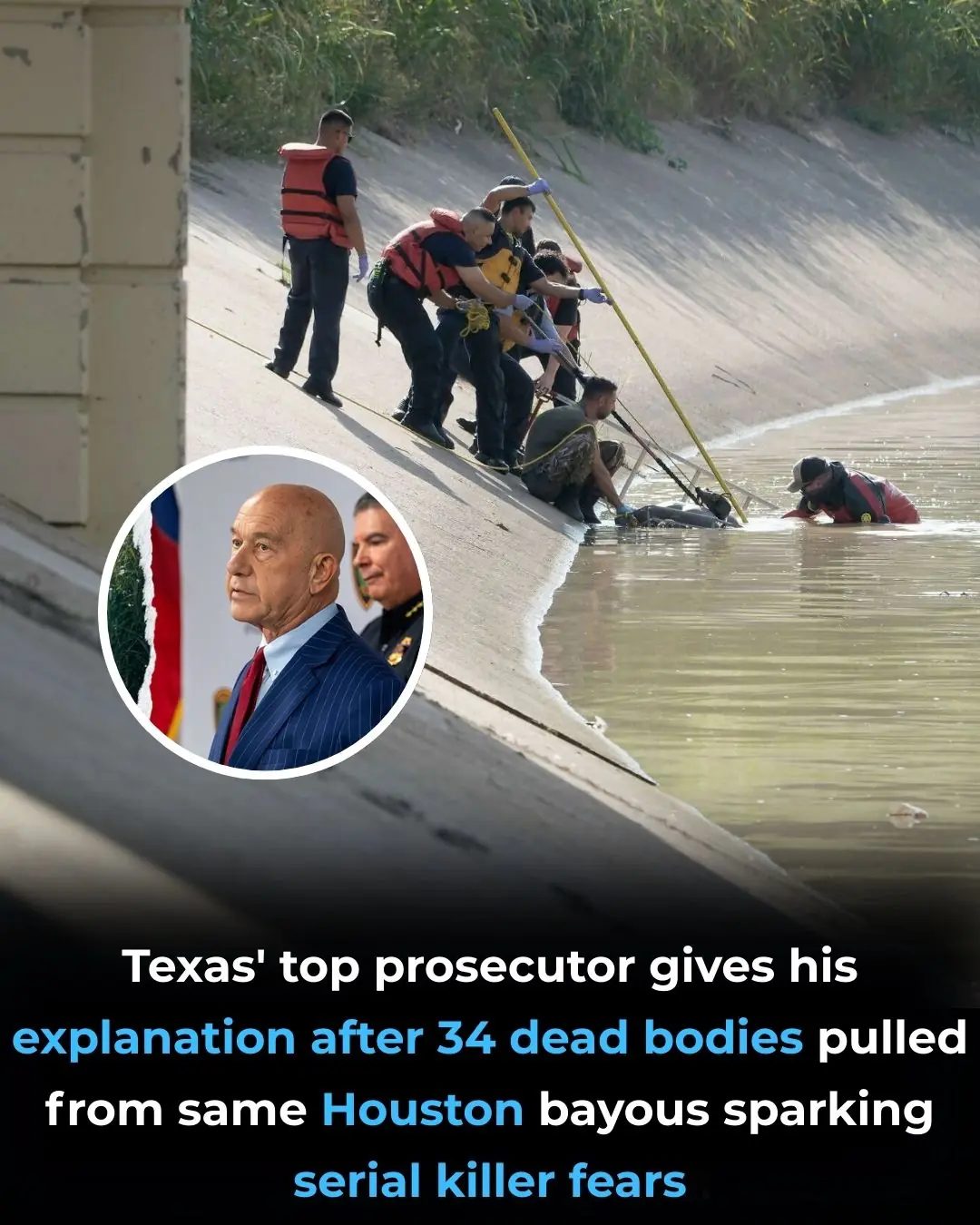

Texas’ top prosecutor gives his explanation after 34 dead bodies pulled from same Houston bayous sparking serial killer fears

Common Blood Pressure Drug Hydrochlorothiazide Linked to Higher Skin Cancer Risk, New Studies Warn

Top 10 Magnesium-Rich Foods That Can Help Lower Blood Pressure Naturally

How to Reduce Uric Acid Crystals Naturally and Lower the Risk of Gout and Joint Pain

Why Do Women Cross Their Legs When Sitting

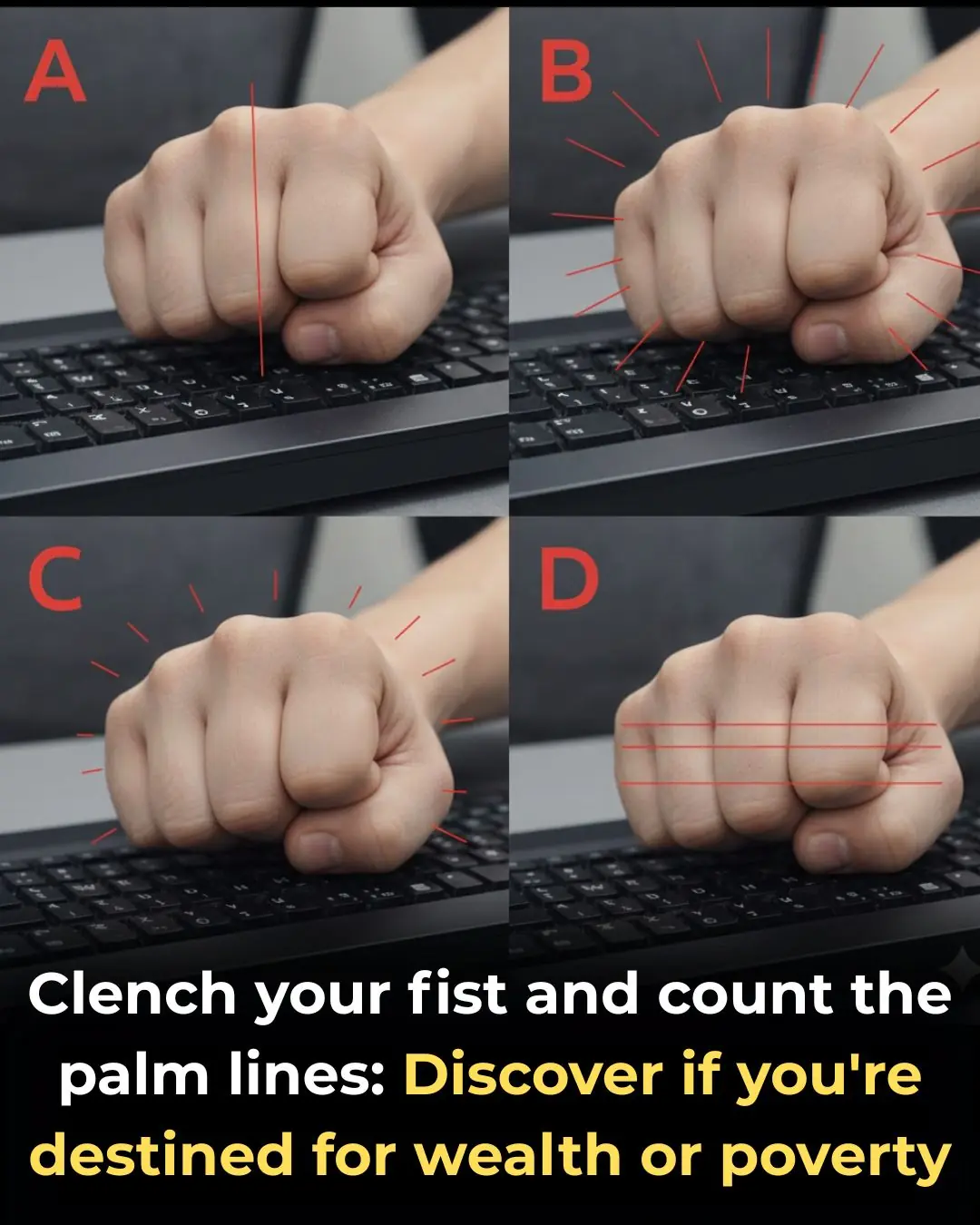

Clench Your Fist And Count The Palm Lines

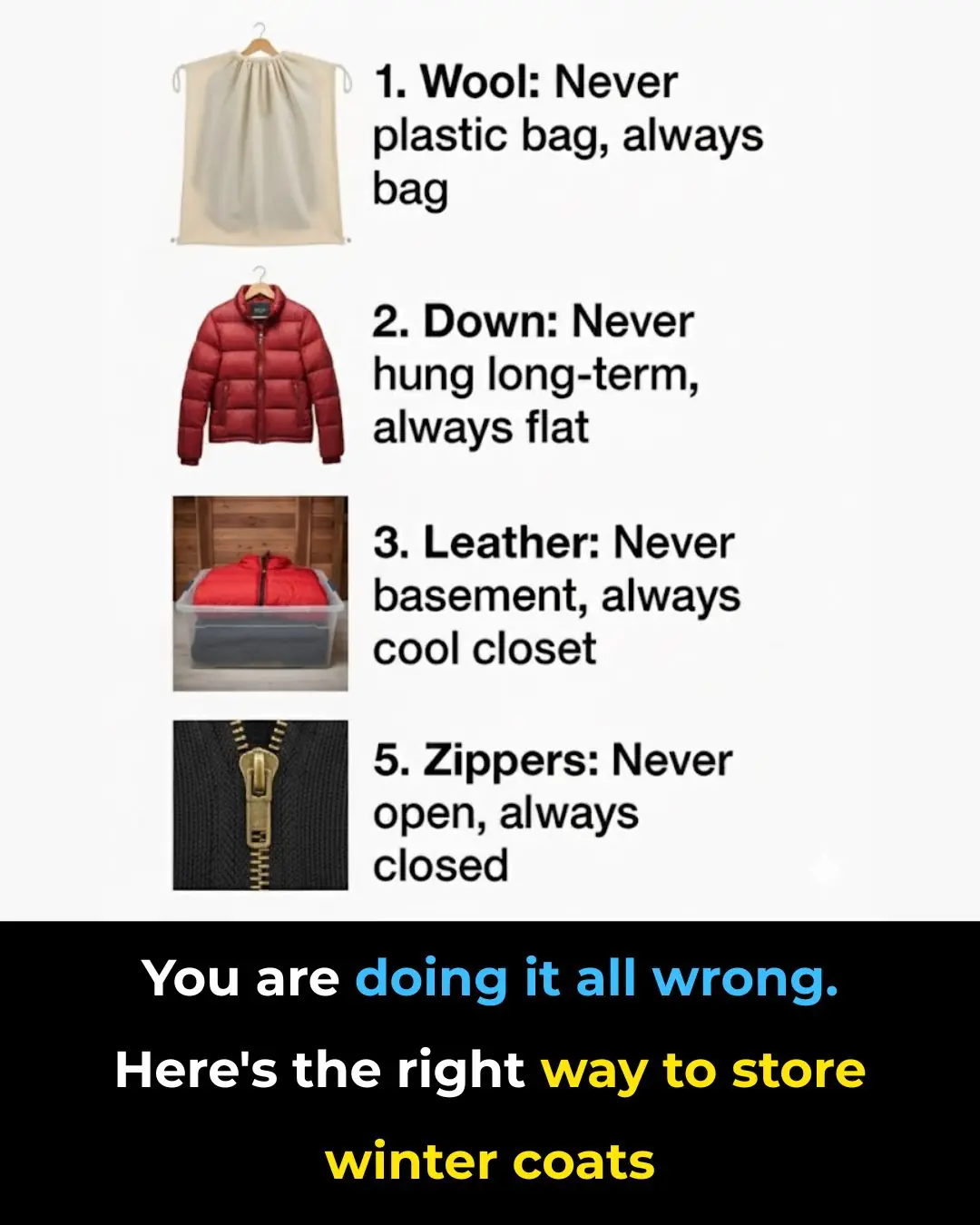

You’re Doing It All Wrong: The Right Way to Store Winter Coats

I Found a Tiny Red Object With Metal Prongs in My Kitchen Drawer — Here’s What It Actually Is

8 Reasons Why Adding Baking Soda to Your Toilet Tank Is a Must-Try Trick

Quick Ways to Stop a Draft Under Your Front Door — While You Wait for the Handyman

Most People Will Go Their Entire Lives Without Knowing What the Decorative Bands on Bath Towels Really Mean

‘Black Diamond’ Apples Exist — A Rare Variety Only Found in China And Tibet

Norway Declares Nationwide Ban on Deforestation In World-First

Finally! People Are Getting Fined for Loud Speakerphone Calls in Public

Don’t Sleep With Your Pets

The Meaning of Having an Unmade Bed

News Post

When you reach 60, the best way to live a healthy and long life isn't through excessive exercise, but through these four habits

My nana taught me this hack to get rid of puffy eyes in 2 mins with 0 work. Here’s how it works

Shoulder Pain from Sleeping: Causes, Solutions and More

Top Signs Your Body is Toxic and What to Do About It

How Water Fasting Can Regenerate the Immune System, Slow Aging, Reduce Heart Attack Risk and More

Ja Rule Says He's 'Very Happy and Excited' to Become a Grandfather, Adds It's a 'Blessing' (Exclusive)

Colon Cleansing With Kefir and Flaxseed Meal

David Spade says he spent 25 years trying to get Eddie Murphy to stop hating him: 'He was a hero'

Beyoncé Is Now A Billionaire

Texas’ top prosecutor gives his explanation after 34 dead bodies pulled from same Houston bayous sparking serial killer fears

CRISPR-Edited Islet Cell Transplantation: A New Therapeutic Horizon for Type 1 Diabetes

Reversing Alzheimer’s Disease by Restoring Brain Energy Metabolism: Implications of a 2025 Breakthrough Study

Fermented Royal Jelly and Enhancement of Human Mucosal Immunity

Coenzyme Q10 Supplementation and Survival in Chronic Heart Failure: Evidence from the Q-SYMBIO Trial

Vitamin C Status, Fat Oxidation, and Fatigue: Evidence from a Human Metabolic Study

Household Clutter as a Chronic Stressor for Women: Psychological and Physiological Evidence

Hercules: The Starving Puppy Who Found Love and Life Again

🐾 In Memory of Peyton