Here’s how much the Powerball winner will owe in taxes after the $1.8 billion jackpot

Saturday’s historic drawing has sparked a frenzy among hopeful players across the nation, each dreaming of instant riches. Yet experts caution that while the advertised jackpot sounds life-changing, the reality is that a substantial slice will never reach the winner’s pocket. Federal and state taxes will take a colossal bite out of the prize, ensuring that Uncle Sam ends up being one of the biggest winners of the night.

How the Tax Breakdown Works

By law, lottery organizers must withhold 24% of the jackpot for federal income taxes right away. On Saturday’s record-breaking prize, that means the winner would automatically forfeit around $198.3 million before even seeing the check, according to CNBC.

But that’s only the beginning. With winnings this massive, the individual will be pushed into the highest 37% federal tax bracket, translating to an even larger obligation at tax time. Depending on where the winner lives, state taxes could add another painful layer to the bill. For example, in New York, lottery earnings are taxed at a steep 10.9%, which could cost an additional tens of millions.

Lump Sum vs. Annuity: The Big Choice

Winners face a life-changing decision when it comes to how they want their prize:

- Lump Sum: An immediate payout estimated at $826.4 million after the deductions — far less than the advertised jackpot, but money in hand right away.

- Annuity: The full $1.8 billion, paid out over 30 years, with annual installments that grow by 5% each year.

Financial experts often recommend the annuity option for long-term security, pointing out that it provides decades of guaranteed income and protection from reckless spending. However, most winners still gravitate toward the one-time payday, tempted by the idea of instant wealth.

The Odds and the Dream

With odds of winning at just 1 in 292 million, hitting the Powerball is statistically less likely than being struck by lightning several times. Yet the dream continues to lure millions of players, especially since no one has claimed the jackpot since May 31. Each rollover has only swelled the prize, building one of the most highly anticipated drawings in lottery history.

The Harsh Reality Behind the Hype

While $1.8 billion sounds like a fairy tale, the reality is more sobering: the final take-home amount will be dramatically reduced once federal and state authorities get their share. For the winner, it’s a bittersweet reality—instant fame and unimaginable wealth, tempered by the sobering truth that nearly half the prize disappears in taxes.

Still, for that one ticket holder who beats the odds, even a reduced payout will be enough to join the ranks of the world’s wealthiest overnight.

News in the same category

Experts reveal the five foods you should absolutely never freeze

Casino Scandal: Woman Denied £33 Million Jackpot and Offered a Steak Dinner Instead

A New York woman’s dream of instant fortune turned into a nightmare after a slot machine declared her the winner of nearly £33 million—only for the casino to claim it was a “malfunction” and offer her a steak dinner as compensation.

Look-alike athletes who even share the same name took DNA test to see if they’re actually related

It sounds like the plot of a sports comedy, but it actually happened. Two professional baseball players who looked like mirror images of each other — and even shared the exact same name — decided to take a DNA test to uncover whether fate had made the

How much Powerball winner could owe in taxes after winning staggering $1,800,000,000 jackpot

Keira Knightley had to go through years of therapy to get over trauma after starring in Pirates of the Caribbean

Firefighter reveals Princess Diana's last four words before she died

Nearly three decades after Princess Diana’s tragic death, a firefighter who held her hand in her final moments has shared what she said before losing consciousness. His emotional recollection sheds new light on one of the most heartbreaking nights in mo

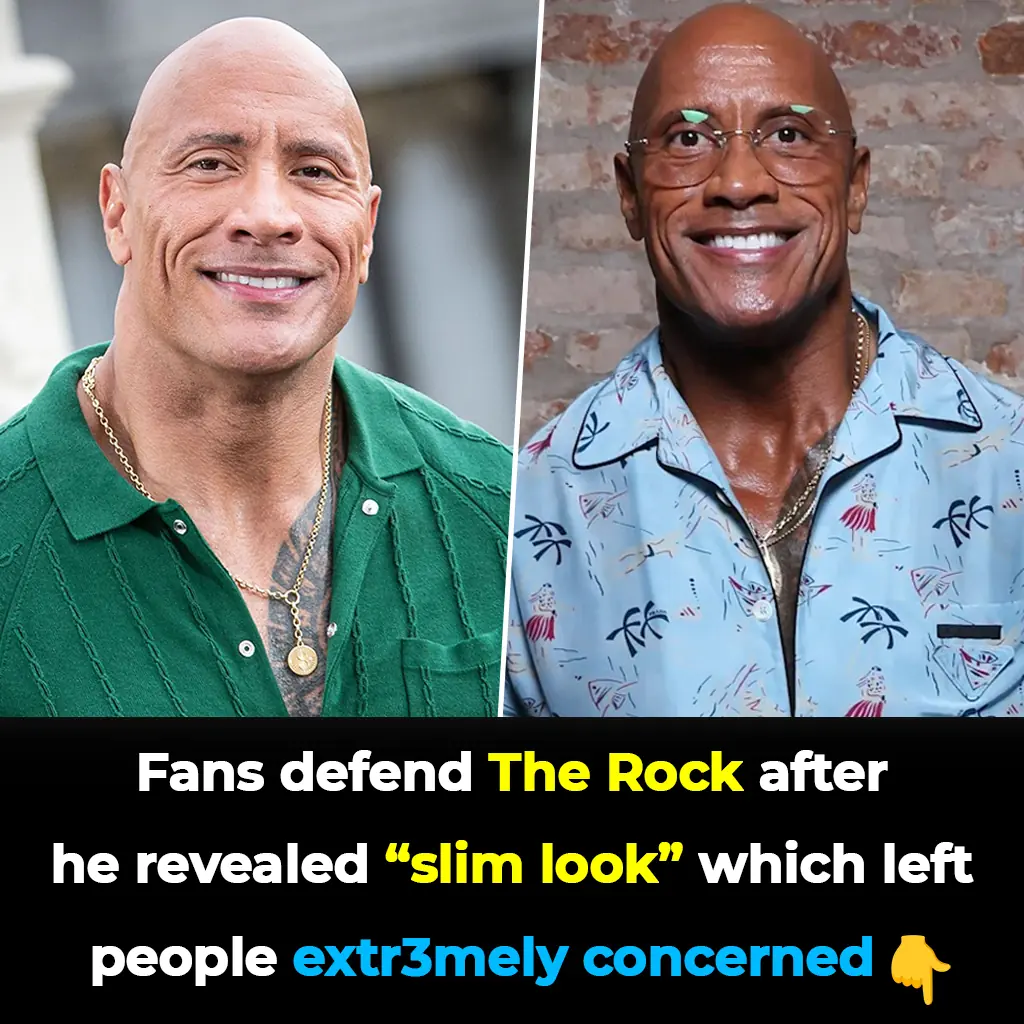

Fans defend The Rock after he revealed 'slim' look which has left people extremely concerned

Dwayne “The Rock” Johnson stunned audiences with a dramatically leaner appearance at the Venice Film Festival, sparking a wave of divided reactions online. While some fans voiced concern for his health, others rushed to defend the Hollywood icon, remi

Elon Musk's daughter shares very honest message after cutting ties with billionaire dad who claimed she was dead

Vivian Wilson, the estranged daughter of tech mogul Elon Musk, has once again spoken out about life after severing ties with her world-famous father. In a rare and unfiltered message, she shed light on her personal struggles, her independence, and the rea

California hospital staff fired following 'dehumanizing' TikTok ridiculing their patients

What began as a short social media clip has ended in a scandal that shook a California healthcare network. A group of hospital workers recorded a TikTok mocking their patients—an act described as “dehumanizing”—and have now all been dismissed foll

Before-and-after images show effects space had on NASA astronauts after 9 months

What was supposed to be a short visit turned into nearly a year away from Earth. Now, newly released before-and-after images of two NASA astronauts show just how profoundly nine months in space can reshape the human body.

NASA just took the closest-ever images of the sun, and they are incredible

For the first time in history, humanity has peered closer into the blazing heart of our star than ever thought possible. NASA’s Parker Solar Probe has delivered astonishing images and video of the sun’s surface and atmosphere, revealing mysteries that

The Shocking Truth Behind “Bleach” Stains on Underwear – What Your Body Is Really Telling You

Many people are startled when they notice pale or bleach-like patches on their underwear and immediately assume something must be wrong. But far from being a sign of poor hygiene, this natural occurrence is actually one of the strongest indicators of a he

There Is One Sound A Person Makes That Means They Have Less Than 24 Hours To Live

As the body approaches its final hours, loved ones may hear a sound known as the “death rattle,” a sign that often causes deep concern. Though unsettling, this natural process is not painful for the person and understanding it can bring comfort to fam

10-year-old baseball star dies suddenly after championship game

Scientists predict what influencers will look like in 2050 and it's horrifying

World-famous hacker reveals scary reason why you should never share iPhone chargers

Terri Irwin makes heartbreaking admission 19 years after Steve’s death

News Post

Fix a clogged showerhead with weak water flow in just 3 minutes – no need to spend money on a replacement

Experts reveal 3 ways to eliminate E. coli bacteria in water – essential knowledge to protect your family

Put a handful of salt into a dirty toilet with yellow stains: Just 30 minutes later, you will see a miracle

The most correct way to give first aid for stroke at home

Cook black bean sweet soup quickly, delicious, not time consuming, save gas/electricity

Apple insider reveals new leaks about foldable iPhone release for 2026

Experts reveal the five foods you should absolutely never freeze

The difference between the spirit of a loved one and other forces

Your Heart Emits a Magnetic Field 100x Stronger Than Your Brain – And It Can Be Detected 3 Feet Beyond Your Body

🌱 Discover Papaya Seeds: Nature’s Tiny Powerhouse for Total Wellness

3 Home Remedies to get rid of Skin Tags – Skin Tag Removal

Homemade Herbal Bath Powder For Clear Skin: Bridal Skincare Ubtan

Mix Baby Oil with Vaseline: The Simple Skincare Trick for Youthful, Wrinkle-Free Skin

How Your Body Secretly Tells You You're Stressed

New Study Shows That Sitting in Silence for Only Two Hours Can Trigger Significant Growth in New Brain Cells

Foods That Can Quietly Drain Calcium From Your Body

Just Simply Looking at a Sick Person Is Enough to Trigger Your Immune Response, Study Shows

Scientists Discover an “Off Switch” for Cholesterol — And It Could Save Millions of Lives

Why Does Your Eye Twitch Randomly? An Eye Doctor Explains