Silver Soars to $59 Per Ounce: A Historic Surge Driven by Demand and Supply Shortages

2025 is proving to be a historic year for silver, with the precious metal breaking new records and reaching $59 per ounce, its biggest leap in years. This dramatic rise has set the global markets abuzz, drawing attention to silver's remarkable surge in value.

So, what’s driving this sudden boom?

Experts point to several factors contributing to silver’s rapid ascent. First and foremost is the growing supply shortage. Mining output has failed to keep pace with global demand, creating a significant gap in the market. This scarcity has played a crucial role in driving prices higher, as silver becomes increasingly harder to find and extract.

Another major factor fueling silver’s rise is its exploding industrial demand. Silver is not only prized for its role in jewelry and investment but has become an essential resource in industries such as solar panels, electric vehicles (EVs), batteries, and semiconductors. As technology advances and the world shifts toward greener energy solutions, silver's role in manufacturing has become more critical than ever before. The high conductivity of silver makes it indispensable in these applications, further increasing its demand.

At the same time, the weak dollar and expectations of Federal Reserve rate cuts have pushed many investors to seek refuge in commodities like silver. As the dollar weakens and inflation concerns persist, commodities such as gold and silver are often seen as safer bets, offering a hedge against economic uncertainty.

Moreover, there is also a noticeable increase in safe-haven demand due to geopolitical tensions around the globe. In times of uncertainty—whether caused by conflict, political instability, or economic crises—investors turn to precious metals like silver as a stable store of value. This has added to the upward pressure on silver prices.

Silver is no longer just a precious metal; it has become one of the most important industrial resources in the world. As the global economy continues to evolve, silver’s dual role as both a valuable commodity and a critical industrial material positions it uniquely in the market. With experts forecasting a continuing global supply deficit and demand continuing to grow, many believe that silver could push past the $60-per-ounce mark in the near future, making it an increasingly attractive investment.

The big question now is whether silver, often viewed as one of the most undervalued assets of the decade, is finally waking up to its full potential. As it continues to rise in value, it’s becoming clear that silver’s time may have come—and investors should be watching closely.

News in the same category

Why Successful People Often Wear Rings on Their Right Hand

Which Raw Food Would You Eat

88-Year-Old U.S. Army Veteran Receives Generous Retirement Gift After Viral Video Inspires Global Donations

Blood Falls: Antarctica's Mysterious Red Waterfall That Never Freezes

Brazilian Skydiver Drops 100 Million Tree Seeds to Help Restore the Amazon Rainforest

Japan Unveils Its First Hydrogen-Powered Train, Paving the Way for Clean and Sustainable Transportation

China's AI-Powered, Driverless Tractors Revolutionize Farming with 5G Connectivity and Precision Agriculture

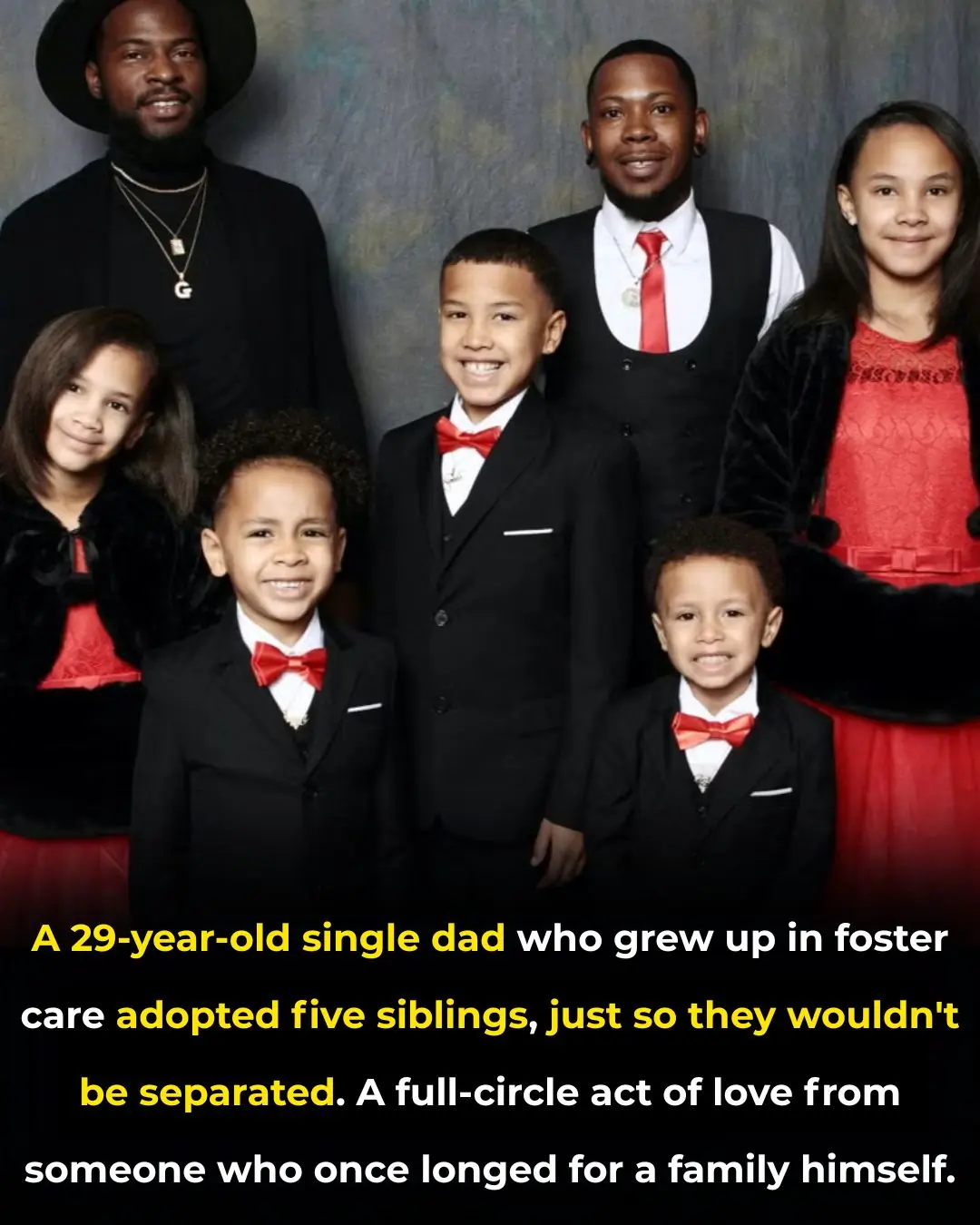

Single Father from Cincinnati Adopts Five Siblings to Keep Them Together, Inspiring Others with His Act of Love and Compassion

Why You Shouldn’t Be Washing Bath Mats in the Washer

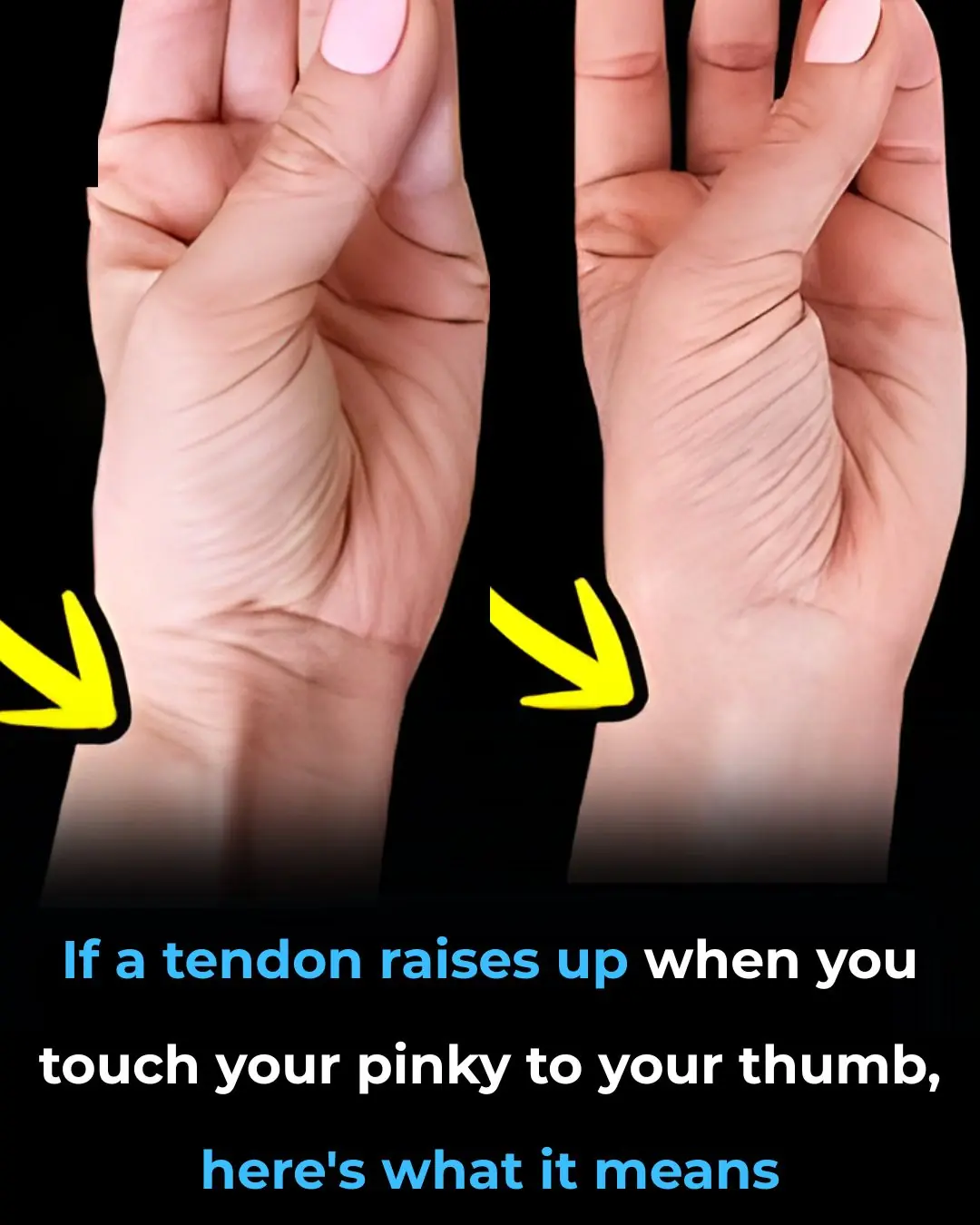

Connection Between Your Tendon and Evolution

7 warning signs your heart might not be well (and 7 symptoms of heart problems)

12 silent signs that your legs may be in worse shape than you think

12 Drinks With Surprising Amounts of Sugar

Victoria Wright: A Powerful Story of Confidence, Courage, and True Self-Love

Dubai’s Proposed Moon-Shaped Resort: A Futuristic Concept Aiming to Redefine Luxury Travel

Rare Cat Found Living On The Tallest Mountain In The World

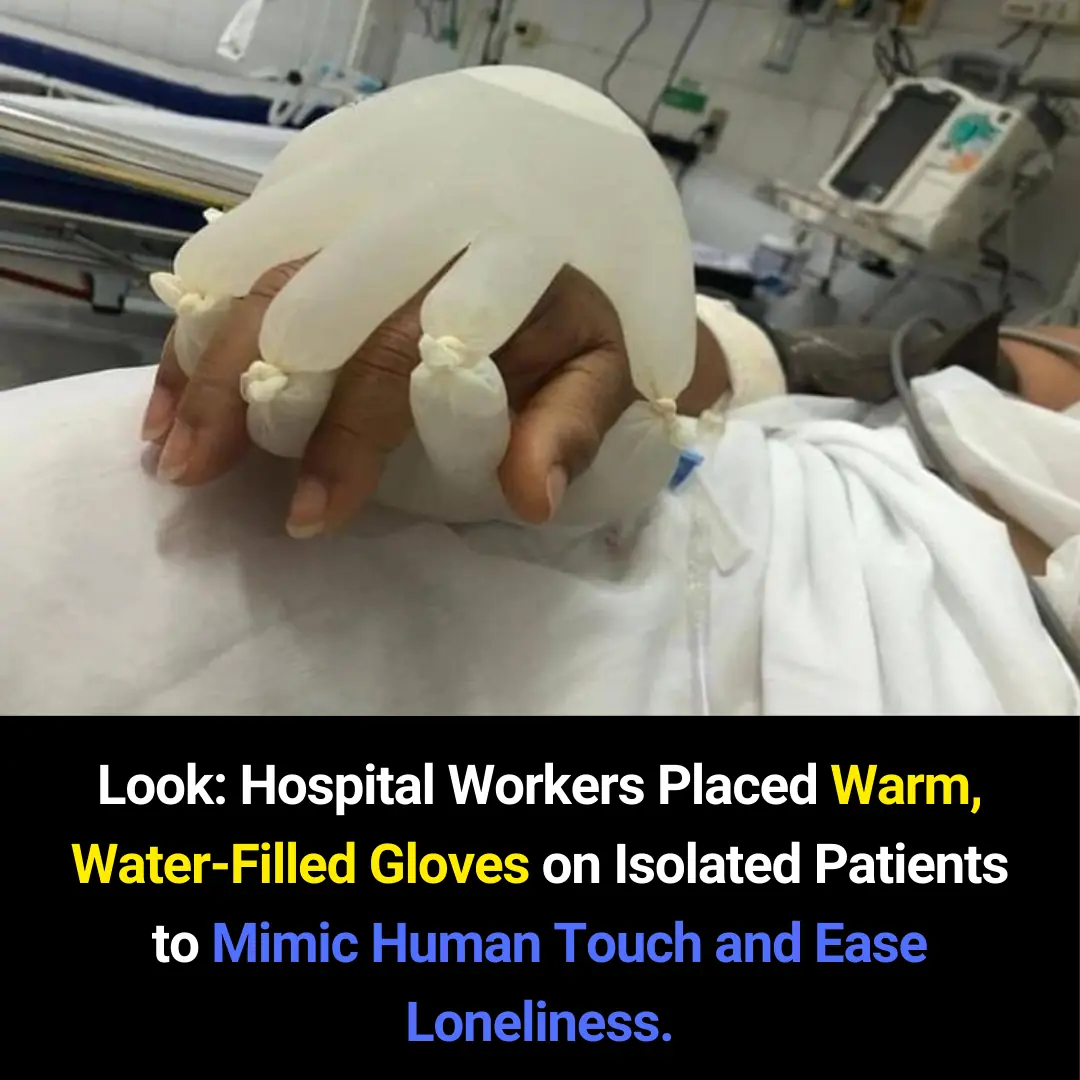

The Inspiring Story Behind the Viral “Hands of Love” Photo During the COVID-19 Pandemic

Descend Into the Heavenly Pit: Exploring Xiaozhai Tiankeng, the World’s Deepest Sinkhole

Photo Of AOC Turns Heads Online After People Spot Unexpected Detail

News Post

His whole body was itchy, he thought it was an allergy but then he was diagnosed

Plant in the Bible Said to Heal All Ailments

Why Successful People Often Wear Rings on Their Right Hand

Which Raw Food Would You Eat

Study: nearly all heart attacks and strokes linked to 4 preventable factors

Panic Attacks And Anxiety Linked To Low Vitamin B6 And Iron levels

10 Immediate Ways To Detox Your Lymph Nodes And Clear Out Toxins That Make You Sick

The #1 seed flour people over 60 use for steady energy and strength

Top 10 Foods to Control Diabetes

How aspirin can help unclog arteries and prevent heart issues

88-Year-Old U.S. Army Veteran Receives Generous Retirement Gift After Viral Video Inspires Global Donations

Blood Falls: Antarctica's Mysterious Red Waterfall That Never Freezes

Brazilian Skydiver Drops 100 Million Tree Seeds to Help Restore the Amazon Rainforest

Japan Unveils Its First Hydrogen-Powered Train, Paving the Way for Clean and Sustainable Transportation

China's AI-Powered, Driverless Tractors Revolutionize Farming with 5G Connectivity and Precision Agriculture

Saffron for Vision: The Natural Reset That Can Transform Your Eyes in 90 Days

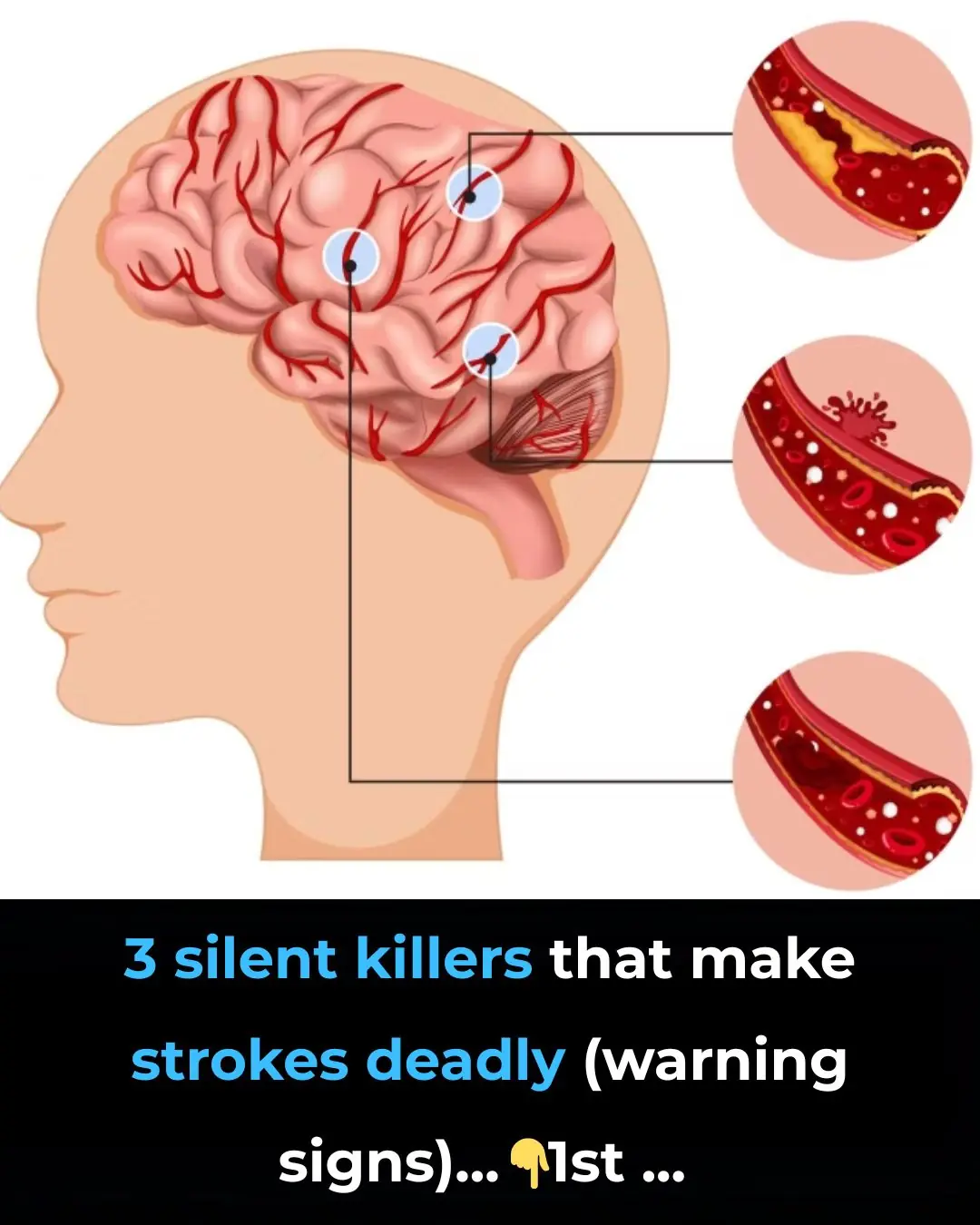

3 silent killers that make strokes deadly (warning signs)

Single Father from Cincinnati Adopts Five Siblings to Keep Them Together, Inspiring Others with His Act of Love and Compassion

Olive Oil With Lemon in the Morning: Benefits, How to Make It & the Best Ways to Use It